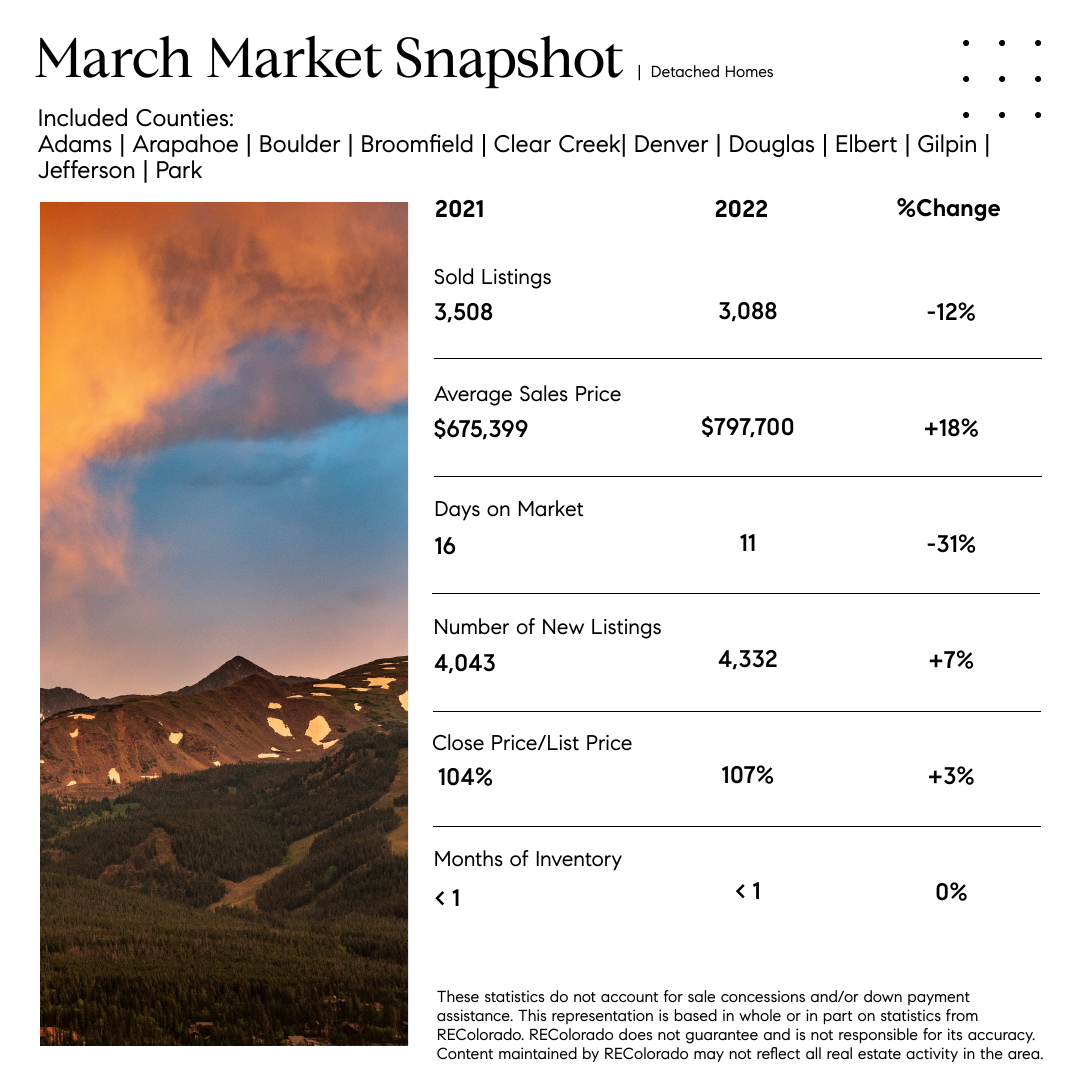

March ‘22 Market Stats - Denver Metro

March's market data is in!

𝗪𝐡𝐚𝐭 𝐈 𝐰𝐚𝐧𝐭 𝐲𝐨𝐮 𝐭𝐨 𝐤𝐧𝐨𝐰 (𝐚𝐧𝐝 𝐭𝐞𝐥𝐥 𝐲𝐨𝐮𝐫 𝐟𝐫𝐢𝐞𝐧𝐝𝐬)…

🚨There is a lot of talk about an inflation, a bubble and a recession. This real estate market is more protected than ever before. Denver’s financed buyers have an average of 729 FICO score and are, on average, putting 28% down. Today, the Household Real Estate Percent Equity is 69%. In 2008, it was only 46%. A recession is correctly defined by 2 consecutive quarters of GDP decline, not a housing bubble. Given today’s supply chain restraints, two-quarters of a reduction in spending will allow this market to balance. The same is true of housing.

𝘓𝘰𝘤𝘢𝘭

💧Douglas County needs to find new water sources as its population grows by 25 people every day. Growth is expected to continue in the county, with nearly 60,000 more people projected to move to the area by 2030.

☁️Denver’s air is getting worse according to an IQAir report. 2020 brought the highest levels of air pollution the Denver metro area has seen in a decade. The cause has been attributed to the raging wildfires across the state. There has been a huge increase in the alerts warning of higher levels of PM2.5.

🔻254 homes in Colorado went into foreclosure in February of 2022. Those properties were in Jackson, Delta, Phillips Morgan and Archuleta counties.

𝘕𝘢𝘵𝘪𝘰𝘯𝘢𝘭

👽Millennials now make up 43% of homebuyers, the most of any generation and an increase from 37% last year.

⚖️A White House interagency task force has outlined a plan aimed at rooting out racial and ethnic bias in home valuations. The Property Appraisal and Valuation Equity task force released a 5-step action plan in increase oversight and accountability.

📑The National Association of REALTORS 2021 Profile of Home Buyers and Sellers reported that 1st time buyers make up 34% of all homebuyers.