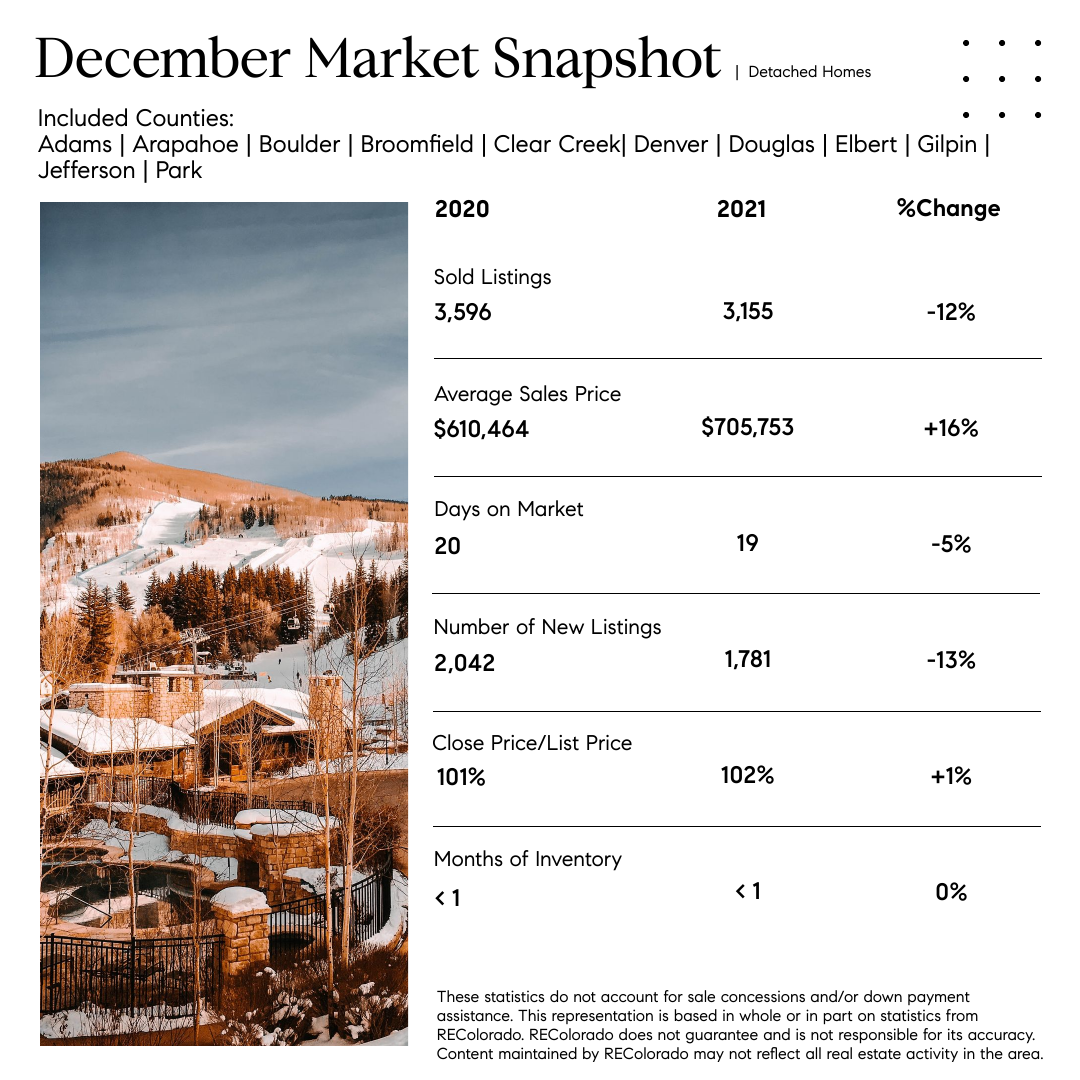

Dec ‘21 Market Stats - Denver Metro

December’s market data is in! What you need to know:

𝘓𝘰𝘤𝘢𝘭

📈Based on the sustained demand for housing and lack of inventory, the market is projected to see double-digit appreciation this year, which it has not seen in back-to-back years of double-digit appreciation since 2015-2016 and 1998-2000.

💔It’s no secret that we tragically lost almost 1,000 homes in the Marshall and Middle Fork fires, Many of those homes fell within the Luxury Market (properties valuing over $1m). The loss of those homes puts further pressure on an already tight real estate market.

🔺In Denver, investors bought 17% of all homes in the 3rd quarter of 2021, up from 9%. Buyers of these come are both institutional investors and smaller, local investors.

📍Federal Heights was named the most affordable municipality in Colorado by the money management site, SmartAsset.

💸Denver’s rent is not up 17.7%, who is almost a $300/month jump. That same $300 would give a buyer $70,000 more in purchasing power. It’s time to stop renting if you can. I feel like I’m always saying this, but the numbers don’t lie. If you’re trying to make the transition from renter to owner, let’s chat.

𝘕𝘢𝘵𝘪𝘰𝘯𝘢𝘭

⏰Mortgage rate update - the Fed gave rates a quick 0.25% jump between December 31st and January 3rd. As mentioned in my latest forecast vide, we expect these to go up to 3.9% for a 30-year term by then end of 2022. These rates are still historically low compared to pre-pandemic rates.

🚨Tip: With the start of the new year, look at your homeowners insurance to make sure you have the proper coverage on your home.